Another Revolut review? Who are these guys and what is their mission? Besides the Blockchain and Cryptocurrencies there is one company that got my attention since they advertise their services with slogans such as “A world beyond banking”. So I thought I will give them a try and since I do many crossborder transactions it seems to make sense to take a closer look at Revolut and write a honest review.

Just to give you an idea, Revolut prides itself in being an alternative to the usual digital banking. It’s simple, user-friendly, and very efficient in what it does. If you want to know more about it, then you’ve come to the right place. Here are some facts that you’d love to hear about Revolut.

The Origins of Revolut

Table of Contents

Revolut was founded by partners Nikolay Storonsky and Vlad Yatsenko in the year 2015. Storonsky, in particular, used to work for both Credit Suisse and Lehman Brothers. His expertise from both these companies was able to give him the foundation needed to push this new innovation. Yatsenko, on the other hand, was a system developer for investment banks. Combining their knowledge on the current state of the financial industry, they were able to come up with the revolutionary app known as Revolut.

Now, Revolut started out as a small prepaid card app which helped travelers change currencies easily at really good rates. This prepaid card app was created because Storonsky became frustrated when the current foreign exchange products were being sold. With that, the company spread their services further to cover a wide range of foreign exchange services to make things convenient for travelers – all with just one card.

How The Revolut Card and App Works

If you’re new to the app, you may want to ask yourself how it works first so that you can get an idea. To briefly explain, you simply load up your Revolut app with money from any bank account of yours. Once you have some money transferred, you can either use your virtual card or a physical card that you order separately to make payments. No matter what card you use, you will control your account via your app. Should you decide to make a purchase abroad, you can either use your base currency and have the app automatically deduct the foreign exchange rate or manually choose the currency you want your money to be in.

If you’re new to the app, you may want to ask yourself how it works first so that you can get an idea. To briefly explain, you simply load up your Revolut app with money from any bank account of yours. Once you have some money transferred, you can either use your virtual card or a physical card that you order separately to make payments. No matter what card you use, you will control your account via your app. Should you decide to make a purchase abroad, you can either use your base currency and have the app automatically deduct the foreign exchange rate or manually choose the currency you want your money to be in.

Example: On my last London trip, the app was aware of my location and I was instead of being a german or swiss card user treated as a UK card user or customer and I could benefit of the best exchange rates compared to most local banks.

Usually, the base currency for Revolut is in Pound Sterling. The great thing about this app is as mentioned that they have really good exchange rates and do not charge any transaction fees. Bank exchange rates are known to be quite horrendous which is why people opt to exchange money in money changers instead. With the app, you don’t have to go to a money changer anymore. The only time when a markup will be applied to your exchange rates would be during weekends since the forex market is closed.

How Do I Sign Up?

Signing up is extremely simple and straightforward. Plus, there is no paperwork that needs to be done, unlike in banks. There are no documents to sign neither are there any specimen cards to submit. All you need to do is have your phone and camera ready. In other words, I think this is the fastest and most simple on-boarding process I have seen so far when it come to financial business.

To open an account, you must first download the app. From there, you decide whether you want to have a free account or a premium account (I think it was 6.99 Pounds per month).

Once you have registered an account, the next thing to do is to submit some verification. First, you need to send a photo of your ID. You must make sure that you take a CLEAR photo wherein all the information in the ID can be seen clearly. Accepted IDs include passports and driver’s licenses. When that’s finished, you must now take a selfie to verify your ID’s authenticity. Once you send that over, you’ll receive a text if the ID scan was approved.

No worries at all, the app will guide you through the entire verification process.

Now, you may choose whether you want to get yourself a physical card like an ATM card or just use the app to pay for whatever you want. If you decide to get a physical card, you need to pay 4.99 Pounds. If you’re a premium member though, you’ll get it for free. Just so you know, this is a Visa prepaid card. It’s similar to a debit card but is accepted by all merchants that accept Visa payments.

When you finish verifying your account, you’ll be prompted to create a pin. This will help you secure your card so that no one can enter your account even if it’s stolen. Once you create your pin, you can now use the physical card.

Downloading and Using the App

Downloading and Using the App

Just like any other mobile app, you download Revolut app through an app store. It can be found in both Google Play and the iTunes Store.

After you have downloaded the app, let’s navigate through it a bit. When you enter the app, you will find four options at the top. These are Invite, Rates, Help, and Profile. Let’s discuss them one by one:

- Invite- The option that allows you to invite other people on the app.

- Rates- This refers to the various forex rates provided by the app.

- Help- The app’s Help section just in case you need support or have queries about the app.

- Profile- The link to your profile where you can change your personal information.

After that, you’ll find six more options in the middle. These are:

- Vaults – This extra section allows you to store loose change or save money for a certain purpose

- Premium – This option allows you to set up a premium account and shows what services are included.

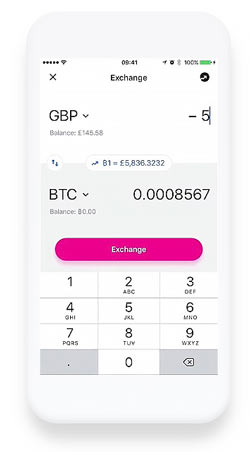

- Cryptocurrencies– This option lets you buy various cryptocurrencies.

- Insurance – This option allows you to pay for various insurance coverage using the app.

- Credit – This section allows you to pay on credit using a p2p lending system.

- Wealth – This one isn’t available yet, so we’ll have to wait and see what it does later.

And some more options as follows:

- Accounts – These would show the details of your account and balances.

- Analytics – This would show you the details of your transactions.

- Payments – This allows you to pay online and transfer money to other people.

- Cards – This section shows you how to order a physical card and control the virtual cards.

- More – This section lets you control the six options usually found in the middle of your screen.

The Main Differences Between the Free Account and Premium Account

Let’s discuss what both of them offer so that you’ll know the difference between the two.

- Free Account

For the free account, you have access to transactions using 150 various currencies at competitive interbank rates. At the same time, you can also transfer money from peer to peer without any fees. Take note though that there is a 0.5% transaction fee for transfers and exchanges if you exceed 5,000 Pounds in a month. For your ATM withdrawals, you are allowed up to 200 Pounds in a month without any transaction fee. If you go over that amount, a 2% fee is applied. Other features include instant notifications and a bill splitting option.

- Premium Account

When you avail of the premium account, you can choose to either pay a monthly fee of 6.99 Pounds or an annual fee of 72 Pounds. That’s really up to how much you can afford. As for the benefits of going premium, let’s start with exchanges. While the free account limits how much you can exchange in a month before adding a transaction fee, the premium account allows you unlimited exchanges at no cost. For ATM withdrawals though, you are given a limit of 400 Pounds in a month before a 2% fee is imposed. As mentioned above, you can get a free physical card. This one is a Mastercard and it will be delivered in three days. Aside from that, we have also mentioned that you have free disposable virtual cards that change card number after each transaction.

Now, one of the main things the premium account has that the free account doesn’t is access to overseas medical insurance. With the premium account, you have a medical insurance of 15 million Pounds. You also have a 300 Pound dental coverage. Take note though that the insurance only covers travelers who stay abroad for 40 days. If you exceed, then the insurance won’t cover you. Another feature is a 20% discount on device coverage, liquid damage coverage, and global coverage.

The Difference Between the Virtual Card and the Physical Card

To be very honest, I never made any use of the physical card until now. I don’t know if I am kind of “conservative old school” or if I am just to ignorant.

However, the main difference between the two would be the fact that the physical card can be touched while the virtual card is inside the app. Aside from that difference, another difference would be that the virtual card doesn’t require a pin since you can’t withdraw money from the virtual card on an ATM machine.

Revolut deems the virtual card to be safer than the physical card because you can delete the virtual card every few months for free and get another. With a physical card, you can’t exactly do that since you need to go to a bank or card provider to change card. If you’re a premium member though, Revolut goes the extra mile for you and deletes your card number after every transaction you make. You’ll then have a new card number right after. This ensures that no one will be able to trace your details. In a way, these two security features do make the virtual card much safer. Also, the virtual card can’t easily be stolen, unlike a physical card. Your phone may get stolen along with your virtual card, but you can always freeze your card and unfreeze it via the app later on when you get a new phone.

What Is a Revolut Business Current Account?

The Revolut Business Current Account targets businesses instead of individuals. While it carries most of the features that the individual account carries, there are extra features here as well. These include:

- Free money transfers from business accounts to other business accounts

- Spend limits for company prepaid cards

- Connect feature to connect current transactions with the business accounting systems

- API for automating offshore payments and money transfers

A Breakdown of the Revolut Fees

Now, reading all of these pieces of information can be quite overwhelming since there are a lot of features and costs that you have to take note of. To make things easier, we’ve created a breakdown of the fees that you have to take note of so that you won’t be surprised if you have to pay for this and that while using the platform. After all, fees are the things that platform users of financial applications look at first. With that, here they are:

- Physical Revolut card order – 4.99 Pounds

- Physical Revolut card order with global express delivery – 11.9 Pounds

- Replacement physical card – 4.99 Pounds

- Replacement virtual card – 4.99 Pounds

- ATM withdrawal fee when withdrawals exceed 200 Pounds (free account) or 400 Pounds (premium account) – 2% of the amount being withdrawn

- Additional charge for exchanges in Thai Baht, Ukranian Hryvnia, and Russian Ruble- 1% of exchange amount

- Mark up during weekends for above-stated currencies – 2% of transaction amount made in the weekend

- Mark up for weekends on all major currencies – 0.5 to 1%

- Premium account cost – 6.99 Pounds per month or 72 Pounds per year

Now let’s talk about the benefits that they offer as compared to many banks.

The Main Benefits of Revolut Vs. Banks

- You can spend and exchange money abroad for free.

- You can make money transfer to bank accounts in more than 100 countries at no cost.

- You can save money using the Vaults feature.

- You can trade cryptocurrencies.

- You can buy insurance for your travels.

- You can apply for a pension plan with PensionBee.

- You can view your spending with the analytics.

How Does Revolut Fare Against its Competitors?

You guys have no idea how happy I was on my last trips having the Revolut card in my wallet. My colleague and I had some quite funny evenings when we made a breakdown on what we have spent during the days and evenings including using ATMs. My colleague who’s opinion was that Fintech companies are pure crap and a hype had some quite expensive surprises, especially when it comes to ATM fees or currency exchange rates. One time an ATM charged him 6 Pounds while I paid 1.50 Pound fee and that’s just one example of many.

With all the information we’ve provided above, you’re probably psyched about using Revolut for your next overseas trip. However, this review doesn’t end here. There are other platforms that are also very similar to Revolut, so it’s important that we see how Revolut fares against them to see if Revolut is definitely worth the cost and the download.

Now, Revolut’s direct competitor is Monzo. Monzo offers services that are almost identical to those that Revolut offer. So with regard to features and even exchange rates, they are pretty much neck to neck. However, there are a few advantages that Revolut has against Monzo. Here are a few that you may want to know:

- Revolut offers cryptocurrency trading services.

- Revolut offers insurance purchases.

- Revolut allows you to borrow money view p2p.

- Revolut gives you the option to apply for a pension.

- Revolut allows you to carry different currencies at the same time in your one account.

- Revolut’s application process is extremely fast and can be done in just minutes.

- Revolut offers cheaper transaction fees as compared to Monzo.

Despite all these, does Monzo have any big advantages over Revolut? As far as our experience is concerned, there is one. Monzo has a bank insurance of 85,000 Pounds which is covered by the Financial Services Compensation Scheme. So in the event that Monzo closes down, 85,000 Pounds from your account is insured and will be returned. This is because Monzo is backed by a licensed bank that gives them the power to have this type of bank insurance. Unfortunately, Revolut doesn’t have this. So if Revolut does close down, there is no guarantee that they will be able to give you back your balance.

Revolut applied for a banking license which allows them to cover a portion of their customers’ balances. Did you know that?

Other competitors of Revolut include Travelex Money Card and Caxton Mastercard. These two alternatives pale in comparison to Revolut with their exchange rates and transaction fees. Of the three, Revolut still offers the most competitive fees and rates. Just to give you an idea, we’ve provided the exchange rates of GBP/USD for all three products.

Revolut offers $1.32051 for every 1 Pound, Caxton offers $1.29081 for every 1 Pound, and Travelex offers 1.2940 for every 1 Pound.

Aside from that, the transaction fees for both Travelex and Caxton are much higher than Revolut. Travelex imposes a 5.75% exchange fee compared to Revolut’s 0.5%. Aside from that, there is also an inactivity penalty of 2 Pounds every month if your card is found to be inactive for a year.

For Caxton, there is a withdrawal charge of 4.50 Pounds and 2% of the withdrawn amount. For exchanges, there is 2.49% markup on the dot. There is also an inactivity fee of 0.85 Pounds per month and a 1.50 Pound charge for purchases and withdrawals in the UK.

Revolut Review – The Bottomline of it All

Through a comprehensive discussion of the features of Revolut as well as a competitor analysis of versus other brands that offer similar services, we can see that Revolut definitely is at the top of its game with regard to the services and products that it offers. If you are looking for a prepaid card that will save you a lot of money and convenience when you travel abroad, we would definitely recommend Revolut. Of course, there still are going to be charges for certain transactions like the withdrawals and currency exchanges. However, these charges are actually kept to a minimum as compared to the other brands that we’ve mentioned.

Now, let’s talk about the premium account. As you can see in the discussion above, the premium account will give you some of the best savings options as there are a lot of no-cost transaction options and minimal limits if you avail of this type of account. However, you do have to pay for the premium status. That said, is it really worth it to avail of the premium account? For us, we would say that it really depends on how much you travel. If you only travel for yearly vacations, like once or twice a year, the premium account may not be ideal for you because the monthly or yearly payment might be higher than the total savings you make. If you travel frequently though (like four times in a year or more), then you will definitely benefit from having the premium account. With the sheer number of transactions that you make in those trips, you will save a lot on transaction fees, interbank exchange markups and more.

Of course, there is one big con from using Revolut, which we have mentioned above. At the moment, Revolut is not a licensed bank, so if ever something happens to it, you stand the chance of losing your money. The other competitors, on the other hand, are covered by the FSCS, so a portion of your money will be protected. As mentioned above as well, Revolut is still in the process of getting a European banking license, so we probably need to wait until they do before we feel safe with the platform.

The Future of Revolut

As long as the company continues to manage the app well, we can definitely expect the platform to grow.

With regard to total market capitalization, the company was valued I think last year at $1.7 billion and is still continues to grow. In fact, company reports show that the company was already able to break even during last year in December. So everything seems to be on track.

I believe that Revolut has a really good future ahead of it and as long as the company continues to provide the users with what they want with utmost smoothness and efficiency, they will succeed.

So what can I say overall? Revolut is a great app that will continue to have steady growth over the next few years. If you travel often, I definitely recommend this app. Make sure to give them a try and if you liked my Revolut review, please leave a comment below. What is your experience with Revolut?

Downloading and Using the App

Downloading and Using the App