The Sumokoin price and my value research.

Table of Contents

Hello world! This is my first public crypto article so go easy on me. I am going to make the case for SUMOkoin (SUMO on Cryptopia) from a pure Sumokoin price and value perspective speaking as a corporate tech lawyer.

I’ve been researching privacy coins deeply and feel I’ve reached a sufficient findings to merit sharing my stance re SUMO.

*As mentioned in previous articles, this is not an investment advice!*

THE BASICS

SUMOkoin is a fork of MONERO (XMR). XMR is a fork of Bytecoin. In my opinion, XMR is hands down the most undervalued coin in the top 15. Its hurdle is that people do not know how to price in privacy to the price of a coin yet. Once people figure out how to accurately assess the value privacy into the value of a coin, XMR, along with other privacy coins like SUMOkoin, will go parabolic.

Let’s be clear about something. I am not here to argue SUMOkoin is superior to XMR. That’s not what this article is about and frankly is missing the point. I don’t find the SUMOkoin vs. XMR debate interesting. From where I stand, investing in SUMOkoin has nothing to do with SUMOkoin overtaking XMR or who has superior tech. If anything, I think the merits of XMR underline the value of SUMOkoin. What I do find interesting is return on investment (“ROI”).

Imagine SUMO was an upcoming ICO. But you knew ahead of time that they had a proven product-market fit and an awesome, blue chip code base. That’s basically what you have in SUMO. Most good ICOs raise over 20mil (meaning their starting market cap is $20 mil) but after that, it’s a crapshoot. Investing in SUMO is akin to getting ICO prices but with the amount of information associated with more established coins.

Let me make one more thing clear. Investing is all about information. Specifically it’s about the information imbalance between current value and the quality of your information. SUMO is highly imbalanced.

The fact of the matter is that if you are interested in getting the vision and product/market fit of a $6 billion market cap coin for $20 mil, you should keep reading.

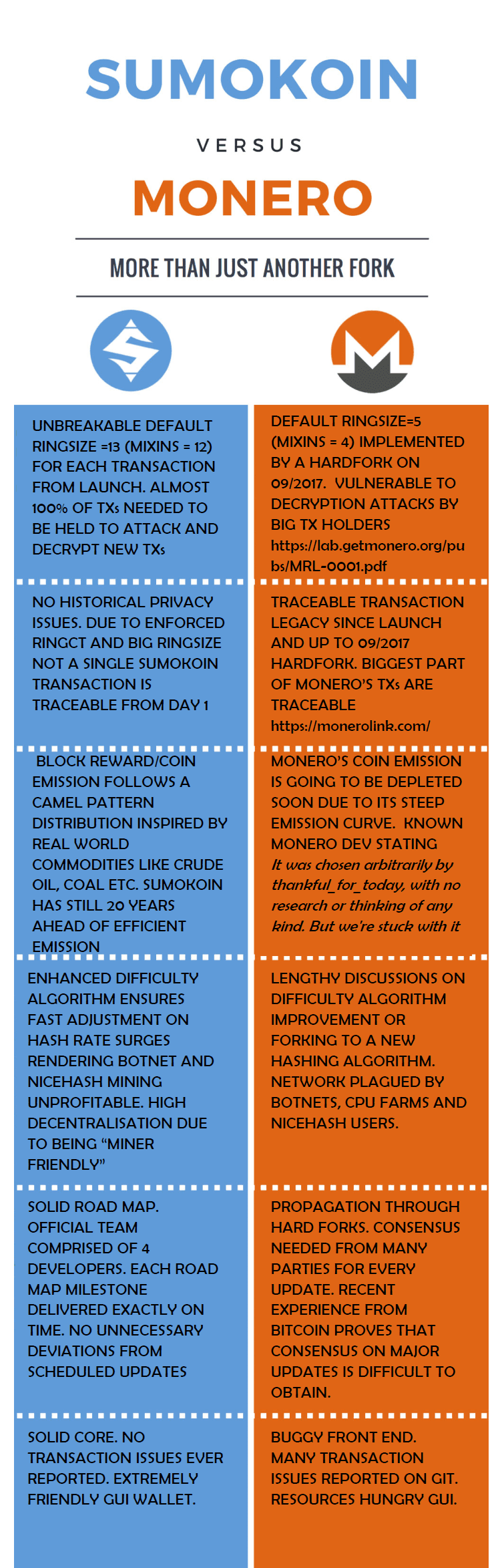

If you are interested in arguing about XMR vs. SUMOkoin, I point you to this infographic:

BACKGROUND

BACKGROUND

I’m a corporate tech & IP lawyer in Silicon Valley. My practice focuses on venture capital (“VC)”) and mergers & acquisitions (“M&A”). Recently I have begun doing more IP strategy. Basically I spend all day every day reviewing cap tables, stock purchase agreements, merger agreements and patent portfolios. I’m also the CEO of a startup (Scry Chat) and have a team of three full-time engineers.

I started using BTC in 2014 in conjunction with Silk Road and TOR. I recently had a minor conniption when I discovered how much BTC I handled in 2014. My 2017 has been good with IOTA at sub $0.30, POWR at $0.12, ENJIN at $0.02, REQ at $0.05, ENIGMA at $0.50, ITC (IoT Chain) and SUMO.

My crypto investing philosophy is based on betting long odds. In the words of Warren Buffet, consolidate to get rich, diversify to stay rich. Or as I like to say, nobody ever got rich diversifying.

That being said I STRONGLY recommend you have an IRA and/or 401(k) in place prior to venturing into crypto. But when it comes to crypto, I’d rather strike out dozens of times to have a chance at hitting a 100x home run. This approach is probably born out of working with VCs in Silicon Valley who do the same only with companies, not coins. I view myself as an aggressive VC in the cryptosphere.

The Number 1 thing I’ve taken away from venture law is that it pays to get in EARLY.

Did you know that the typical founder buys their shares for $0.00001 per share? So if a founder owns 5 million shares, they bought those shares for $50 total. The typical IPO goes out the door at $10-20 per share. My iPhone calculator says ERROR when it tries to divide $10/0.00001 because it runs out of screen real estate.

At the time of this writing, SUMO has a Marketcap of $18 million. That is 3/10,000th or 1/3333th. Let that sink in for a minute. BCH is a fork of BTC and it has the fourth largest market cap of all cryptos. Given it’s market cap, I am positive SUMO is the best value proposition in the Privacy Coin arena at the time of this writing.

ROI MERITS OF SUMOkoin

So what’s so good about SUMOkoin? Didn’t you say it was just a Monero knock-off?

1) Well, sort of. SUMO is based on CryptoNote and was conceived from a fork of Monero, with a little bit of extra privacy thrown in. It would not be wrong to think SUMO is to Litecoin as XMR is to Bitcoin.

2) Increased Privacy. Which brings us to point 2. SUMO is doing several things to increase privacy (see below). If Monero is the King of Privacy Coins, then SUMO is the Standard Bearer fighting on the front lines. Note: Monero does many of these too (though at the time of fork XMR could not). Don’t forget Monero is also 5.8 billion market cap to SUMO’s 18 million.

a) RingCT. All transactions since genesis are RingCT (ring confidential transactions) and the minimum “mixin” transactions is 13 (12 plus the original transaction). This passes the threshold to statistically resist blockchain attacks. No transactions made on the SUMO blockchain can ever be traced to the actual participants. Nifty huh? Monero (3+1 mixins) is considering a community-wide fork to increase their minimum transactions to 6, 9, or 12. Not a bad market signal if you’re SUMOkoin eh?

b) Sub-addresses. The wallet deploys disposable sub-addresses to conceal your real sumo wallet address even from senders (who typically would need to know your actual address to send currency). Monero also does this.

3) Fungibility aka “Digital Cash” aka Broad Use Case. “Fungibility” gets thrown about a bunch but basically it means ‘how close is this coin to cash in terms of usage?’ SUMO is one of a few cryptos that can boast true fungibility — it acts just like physical cash i.e. other people can never trace where the money came from or how many coins were transferred. MONERO will never be able to boast this because it did not start as fungible.

5) Mining Made Easy Mode. Seeing as SUMO was a fork, and not an ICO, they didn’t have to rewrite the wheel. Instead they focused on product by putting together solid fundamentals like a great wallet and a dedicated mining app. Basically anyone can mine with the most intuitive GUI mining app out there. Google “Sumo Easy Miner” – run and mine.

6) Intuitive and Secure Wallet. This shouldn’t come as a surprise, yet in this day and age, apparently it is not a prereq. They have a GUI wallet plus those unlimited sub-addresses I mentioned above. Here’s the github if you’d like to review.

The wallet really is one of the best I have seen (ENJIN’s will be better). Clear, intuitive, idiot proof (as possible).

7) Decentralization. SUMO is botnet-proof, and therefore botnet mining resistant. When a botnet joins a mining pool, it adjusts the mining difficulty, thereby balancing the difficulty level of mining.

8) Coin Emission Scheme. SUMO’s block reward changes every 6-months as the following “Camel” distribution schema (inspired by real-world mining production like of crude oil, coal, etc. that is often slow at first, then accelerated in before decline and depletion). MONERO lacks this schema and it is significant. Camel ensures that Sumokoin won’t be a short-lived phenomena. Specifically, since Sumo is proof-of-work, not all SUMO can be mined. If it were all mined, miners would no longer be properly incentivized to contribute to the network (unless transaction fees were raised, which is how Bitcoin plans on handling when all 21 million coins have been mined, which will go poorly given that people already complain about fees). A good emission scheme is vital to viability.

9) Dev Team // Locked Coins // Future Development Funds. There are lots of things that make this coin a ‘go.’ but perhaps the most overlooked in crypto is that the devs have delivered ahead of schedule. If you’re an engineer or have managed CS projects, you know how difficult hitting projected deadlines can be. These guys update github very frequently and there is a high degree of visibility. The devs have also time-locked their pre-mine in a publicly view-able wallet for years so they aren’t bailing out with a pump and dump. The dev team is based in Japan.

10) Broad Appeal. If marketed properly, SUMO has the ability to appeal to older individuals venturing into crypto due to the fungibility / similarities to cash. This is not different than XMR, and I expect it will be exploited in 2018 by all privacy coins. It could breed familiarity with new money, and new money is the future of crypto.

12) Absent from Major Exchanges. Thank god. ALL of my best investments have happened off Binance, Bittrex, Polo, GDAX, etc. Why? Because by the time a coin hits a major exchange you’re already too late. Your TOI is fucked. You’re no longer a savant. SUMO is on Cryptopia, the best jenky exchange.

13) Marketing. Which brings me to my final point – and it happens to be a weakness. SUMO has not focused on marketing. They’ve instead gathered together tech speaks for itself (or rather doesn’t). So what SUMO needs a community effort to distribute facts about SUMO’s value prop to the masses. A good example is Vert Coin. Their team is very good at disseminating information. I’m not talking about hyping a coin; I’m talking about how effectively can you spread facts about your product to the masses.

To get mainstream SUMO needs something like this VertCoin post

If any of you are capable of the above please contact me or the blog ASAP.

MARKET CAP DISCUSSION

For a coin with using Monero’s tech, 20 million is minuscule. For any coin 20 mil is nothing. Some MC comparisons [as of Jan 2, 2017]:

- SUMO: 18 million

- ENJIN: 150 million (9x)

- Enigma: 465 million (26x)

- REQ: 500 million (28x)

- POWR: 500 million (28x)

- Monero: 5.8 billion (mental maths iz hard)

Let’s talk about market cap (“MC”) for a minute.

It gets tossed around a lot but I don’t think people appreciate how important getting in as early as possible can be. Say you buy $1000 of SUMO at 20 mil MC. Things go well and 40 million new money gets poured into SUMO. Now the MC = 60 million. Your ROI is 200% (you invested $1,000 and now you have 3,000, netting 2,000).

Now let’s says say you bought at 40 million instead of 20 million. $20 mill gets poured in until the MC again reaches 60 mil. Your ROI is 50% (you put in $1,000, you now have 1,500, netting 500).

Remember: investing at 20 mil MC vs. 40 mil MC represents an EXTREMELY subtle shift in time of investment (“TOI”). But the difference in net profit is dramatic. the biggest factor is that your ROI multiplier is locked in at your TOI — look at the difference in the above example. 200% ROI vs. 50% ROI. That’s huge. But the difference was only 20 mil — that’s 12 hours in the crypto world.

I strongly believe SUMO can and will 25x in Q1 2018 (400m MC) and 50x by Q4 2018 reach. There is ample room for a tricked out Monero clone at 1 bil MC. That’s 50x.

Guess how many coins have 500 mil market caps? 58 as of this writing. 58! Have many of these coins with about ~500 mil MC have you heard of?

MaidSafeCoin?

Status?

Decred?

Veritaseum?

DRAGONCHAIN ARE YOU KIDDING ME

THE ROLE OF PRIVACY

I want to close with a brief discussion of privacy as it relates to fundamental rights and as to crypto. 2018 will be remembered as the Year of Privacy Coins. Privacy has always been at the core of crypto. This is no coincidence. “Privacy” is the word we have attached to the concept of possessing the freedom to do as you please within the law without explaining yourself to the government or financial institution.

Discussing privacy from a financial perspective is difficult because it has very deep political significance. But that is precisely why it is so valuable.

Privacy is the right of billions of people not to be surveilled. We live in a world where every single transaction you do through the majority financial system is recorded, analyzed and sold — and yet where the money goes is completely opaque. Our transactions are visible from the top, but we can’t see up. Privacy coins turn that upside down.

Privacy is a human right. It is the guarantor of American constitutional freedom. It is the cornerstone of freedoms of expression, association, political speech and all our other freedoms for that matter. And privacy coins are at the root of that freedom. What the internet did for freedom of information, privacy coins will do for freedom of financial transactions.

—

TL;DR

2018 = Year of Privacy Coins // Monero is most undervalued coin in the Top 15 // SUMO is low market cap XMR fork —> incredible ROI opportunity // ROI is everything // did I mention ROI is everything? // Consolidate to get rich; diversify to stay rich // Extra extra strong code foundation + extra strong dev team // SUMO core team financial incentives locked in multi-year vesting schedule // unlimited sub-addresses associated with Wallet mean complete anonymity // RingCT since genesis w/ 12+1 minimum mixins means 100% confidentiality // Fungibility (like cash) means MARKET VALUE of privacy is baked into the currency (this is huge) // Mining Made Easy for those interested // Botnet mining resistant // unique market appeal to UNSOPHISTICATED pockets due to fungibility similarity to cash.

POST SCRIPT: AN ENGINEER’S PERSPECTIVE

Recently a well respected engineer reached out to me and had this to say about SUMO. I thought I’d share.

“I’m messaging you because I came at this from a different perspective. For reference, I started investing in Sumo back when it was around $0.5 per coin. My background is in CS and Computer Engineering. I currently research in CS.

When I was looking for a coin to invest in, I approached it in a completely different way from what you described in your post, I first made a list of coins with market caps < 20m, and then I removed all the coins that didn’t have active communities.

Next, because of my background, I read through the code for each of the remaining coins, and picked the coins which had both frequent commits to GitHub (proving dev activity), and while more subjective, code that was well written. Sumo had both active devs, and (very) well written code.

I could tell that the people behind this knew what they were doing, and so I invested.

I say all of this, because I find it interesting how we seem to have very different strategies for selecting ‘winners’ but yet we both ended up finding Sumo.”

—

Legal Disclaimer:

THIS POST AND ANY SUBSEQUENT STATEMENTS BY THE AUTHOR DO NOT CONSTITUTE LEGAL OR FINANCIAL ADVICE AND IS NOT INTENDED TO BE LEGAL OR FINANCIAL ADVICE OR RELIED UPON. NO REFERENCES TO THIS POST SHALL BE CONSTRUED AS LEGAL OR FINANCIAL ADVICE. THIS POST REPRESENTS THE LONE OPINION OF A NON-SOPHISTICATED INVESTOR.

BACKGROUND

BACKGROUND